Minneapolis, MN – November 13, 2014 – Clearfield, Inc. (Nasdaq:CLFD), the specialist in fiber management and connectivity platforms for communications providers, today announced that its board of directors has approved a stock repurchase program under which it will begin purchasing up to $8 million of its outstanding shares of common stock.

Cheri Beranek, Chief Executive Officer and President, said, “Clearfield cash and cash equivalent increased by more than $10 million in fiscal year 2014. The combination of Clearfield’s current market valuations, our strong cash balances and cash flow outlook lead us to believe that this stock repurchase program is an appropriate use of cash. This program reaffirms our continued confidence in the company’s near and long-term financial and operating performance, and our commitment to enhancing shareholder value.”

Under the program, Clearfield may purchase shares of common stock from time to time through open market and privately negotiated transactions, through block trades, and pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934. Repurchases of common stock will be made in accordance with Rule 10b-18 of the Securities Exchange Act of 1934 at prices depending on prevailing market conditions.

The program does not obligate Clearfield to repurchase any particular amount of common stock during any period. The repurchase will be funded by cash on hand. The repurchase program is expected to continue indefinitely until the maximum dollar amount of shares has been repurchased or until the repurchase program is earlier modified, suspended or terminated by the board of directors.

About Clearfield, Inc

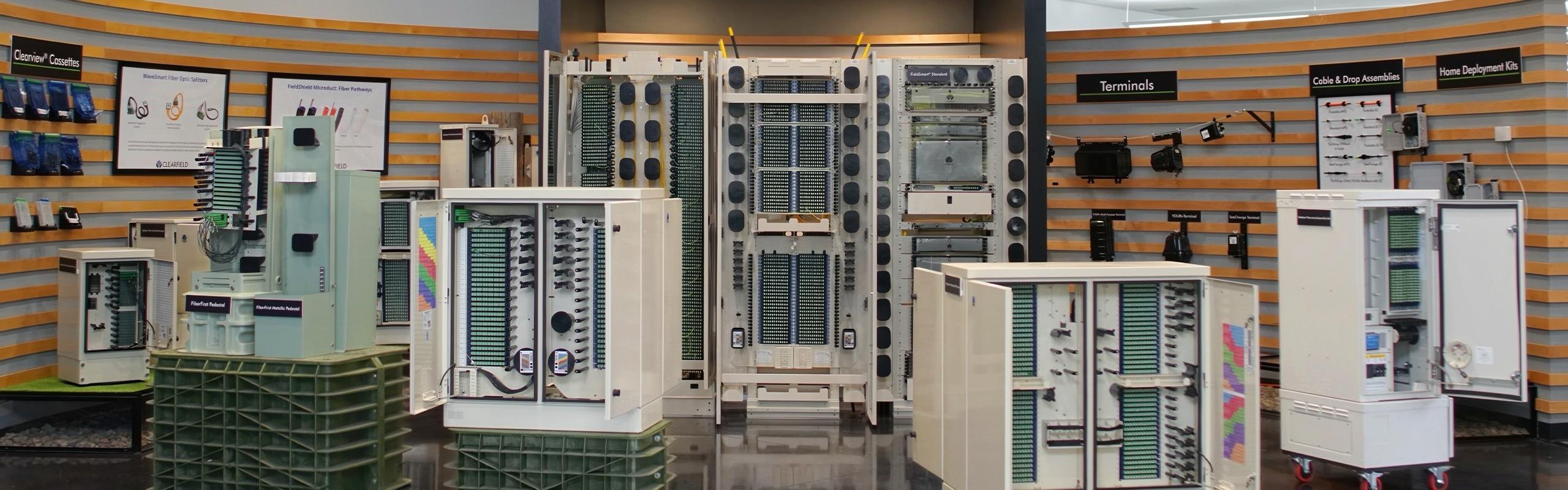

Clearfield, Inc. (NASDAQ: CLFD) designs, manufactures and distributes fiber optic management products for the communications networks of leading ILECS, CLECs, MSO/cable TV companies and mobile broadband providers. We help service providers solve the Fiber Puzzle, which is how to reduce high costs associated with deploying, managing, protecting and scaling a fiber optic network to deliver the mobile, residential and business services customers want. Based on the patented Clearview™ Cassette, our unique single architected, modular fiber management platform is designed to lower the cost of broadband deployment and maintenance by consolidating, protecting and distributing incoming and outgoing fiber circuits and enable our customers to scale their operations as their subscriber revenues increase. Headquartered in Plymouth, MN, Clearfield deploys more than a million fiber ports each year.

Forward-Looking Statements

Forward-looking statements contained herein and in the FieldReport are made pursuant to the safe harbor provisions of the Private Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate” or “continue” or comparable terminology are intended to identify forward-looking statements. Such forward looking statements include, for example, statements about the Company’s future operating performance, including cash balances and cash flows, and the market price of the Company’s common stock. These statements are based upon the Company’s current expectations and judgments about future developments in the Company’s business. Certain important factors could have a material impact on the Company’s performance, including, without limitation the effect of the significant downturn in the U.S. economy on Clearfield’s customers; the impact of the American Recovery and Reinvestment Act or any other legislation on customer demand and purchasing patterns; cyclical selling cycles; need to introduce new products and effectively compete against competitive products; the effectiveness of distributors and new selling channels; dependence on third-party manufacturers and the availability of raw materials, particularly fiber; the success of efforts to reduce expenses through manufacturing improvements and procurement; reliance on key customers; rapid changes in technology; the negative effect of product defects; the need to protect its intellectual property; the impact on its financial results or stock price of its ability to use its deferred tax assets, consisting primarily of net operating loss carryforwards, to offset future taxable income; the valuation of its goodwill and the effect of its stock price, among other factors, on the evaluation of goodwill; and other factors set forth in Clearfield’s Annual Report on Form 10-K for the year ended September 30, 2013 as well as other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update these statements to reflect actual events.